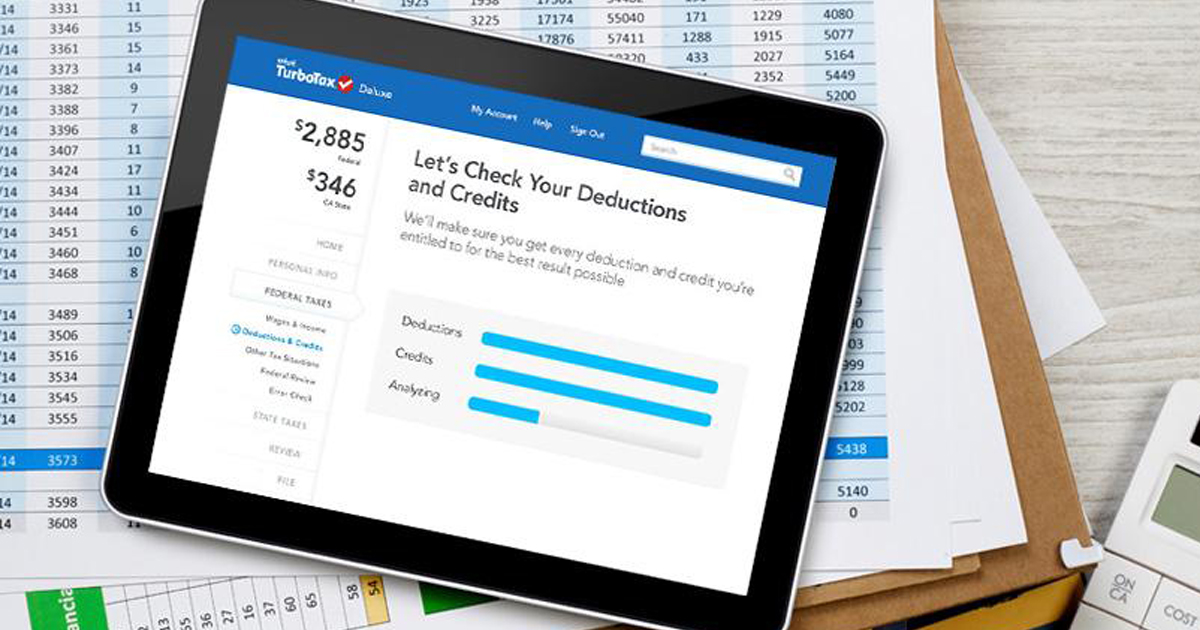

TurboTax does a great job of asking you questions up front that will shape the way the rest of the questionnaire unfolds. I found that the online process was easy to use and the prompted questions were understandable. This year, as last year, in order to input stock or mutual fund sales, a tax filer has to purchase TurboTax Premier or Home and Business. It’s worth noting, however, that the rebate was less than the fees to upgrade to TurboTax’s Premier or Home and Business products. In response, Intuit issued an apology to customers affected by the change and offered a $25 rebate. Without notice, the TurboTax Deluxe edition required users to upgrade to the more expensive Premier or Home and Business services to prepare certain forms, including Schedule C and D, which were available in previous Deluxe versions of the software. While many customers swear by TurboTax’s services, there were disruptions last year when the company did not properly communicate an important change in pricing to customers.

TurboTax is the most widely used tax preparation service today. Handles all forms associated with MLPs (master limited partnerships) and capital gains Since investors must purchase TurboTax Premier, H&R Block Deluxe or TaxAct Plus in order to be able to properly account for their investments, we confine our review to these versions.Īccording to our survey of users, subscribers look for the following features in a tax preparation service:ĭownloads tax information from brokeragesĬovers different tax situations and complex tax issuesĪbility to record investment transactions, including options For each, we give a brief overview, summarize the good and bad features as reported by survey respondents, and discuss the tools available, costs and security.Įach company offers multiple versions of its service. In this article we talk about the three major tax preparation services: TurboTax, TaxAct and H&R Block. A majority of respondents (68%) use TurboTax, while 21% use H&R Block, 7% use TaxAct and 4% use a different service ( Figure 1). The responses were valuable in helping to focus our write-up, and we refer to their comments throughout.Īccording to the survey, roughly 59% of respondents use a tax preparation service to file their taxes. This year, before preparing our review, we surveyed a select group of CI subscribers on which service they use and asked for their input on its benefits and downsides. Each year we review tax preparation services.

0 kommentar(er)

0 kommentar(er)